artience2027, Medium-term Management Plan | Integrated Report 2025Management Strategy: Accelerating growth by investing resources to build on our strengths

Published on June 27, 2025

This page has been translated using AI.

The artience Group has grown by leveraging the technologies and expertise it has developed through its business expansion in diverse markets. To respond to the changing market environment and aim for further growth, the artience 2027, Medium-term Management Plan increases investment in and allocation of resources to the Group’s strongest businesses. Going forward, we will accelerate growth by clarifying our focus areas through a two-pronged approach of transforming existing businesses into highly profitable ones and creating strategic priority businesses.

Hiroyuki Hamada

Progress in business portfolio management

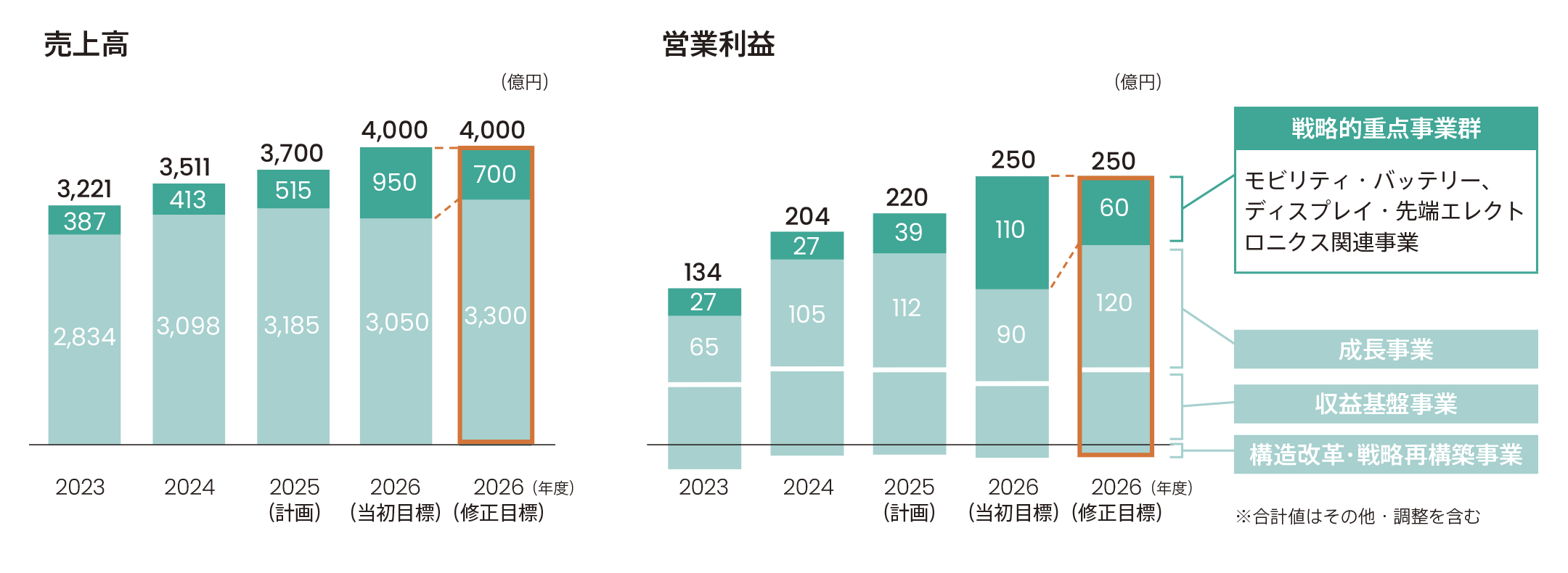

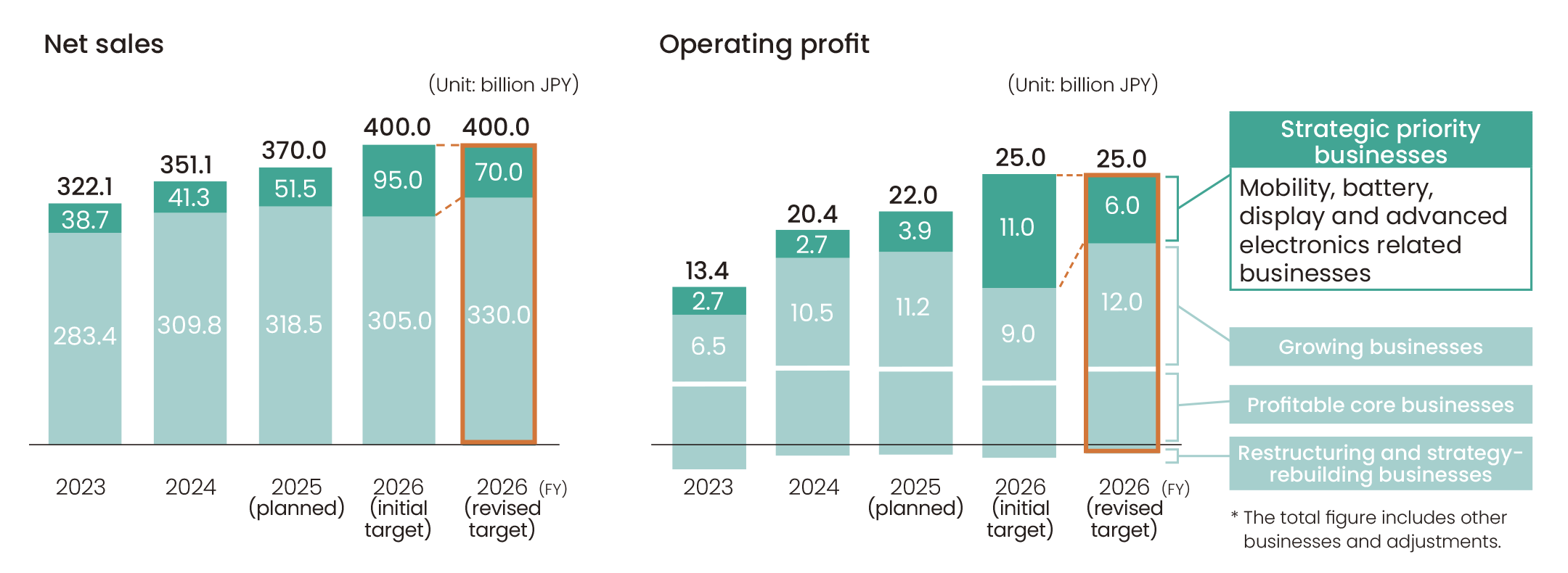

We launched the artience2027, Medium-term Management Plan with growth as our top priority, as a plan to shift to an offensive strategy. In the first year, FY2024, we made progress largely in line with our plan, with net sales, operating profit, and ordinary profit all reaching record highs. In addition to increased profits driven by the weak JPY and stabilized raw material prices overseas, earnings were also boosted by the favorable tax treatment of investments in Turkey.

With artience2027, we are placing particular emphasis on business portfolio transformation. To further strengthen our strengths by leveraging the technologies and expertise we have developed over the years, we have identified two major areas of focus. The first is to shift to existing businesses with high profitability. We will further enhance the profitability of our strong existing businesses while accelerating our expansion into overseas markets. The other is creation of strategic priority businesses. We will create new businesses that will become pillars of future growth and nurture them to maturity. In FY2024, we surpassed expectations in the former, particularly by successfully capturing growth in the Indian market.

When you hear the term “business portfolio transformation, ”you may imagine large-scale divestitures, business withdrawals, or mergers and acquisitions (M&A.) However, our business is characterized by its diversification across markets and regions. While this may be less efficient than rolling out specific products to large markets, our ability to meet a wide range of needs is an advantage, and also acts as a barrier to entry for competitors. In addition, there is also the advantage that businesses can support each other even when some are performing sluggishly.

Therefore, our business portfolio transformation is not simply a replacement of existing businesses, but aims to expand products that meet market needs and high value-added products in each area. To accomplish this, we will fully leverage our strengths in sales, technology, and global networks within our current markets and regions.

Shift to highly-profitable existing businesses

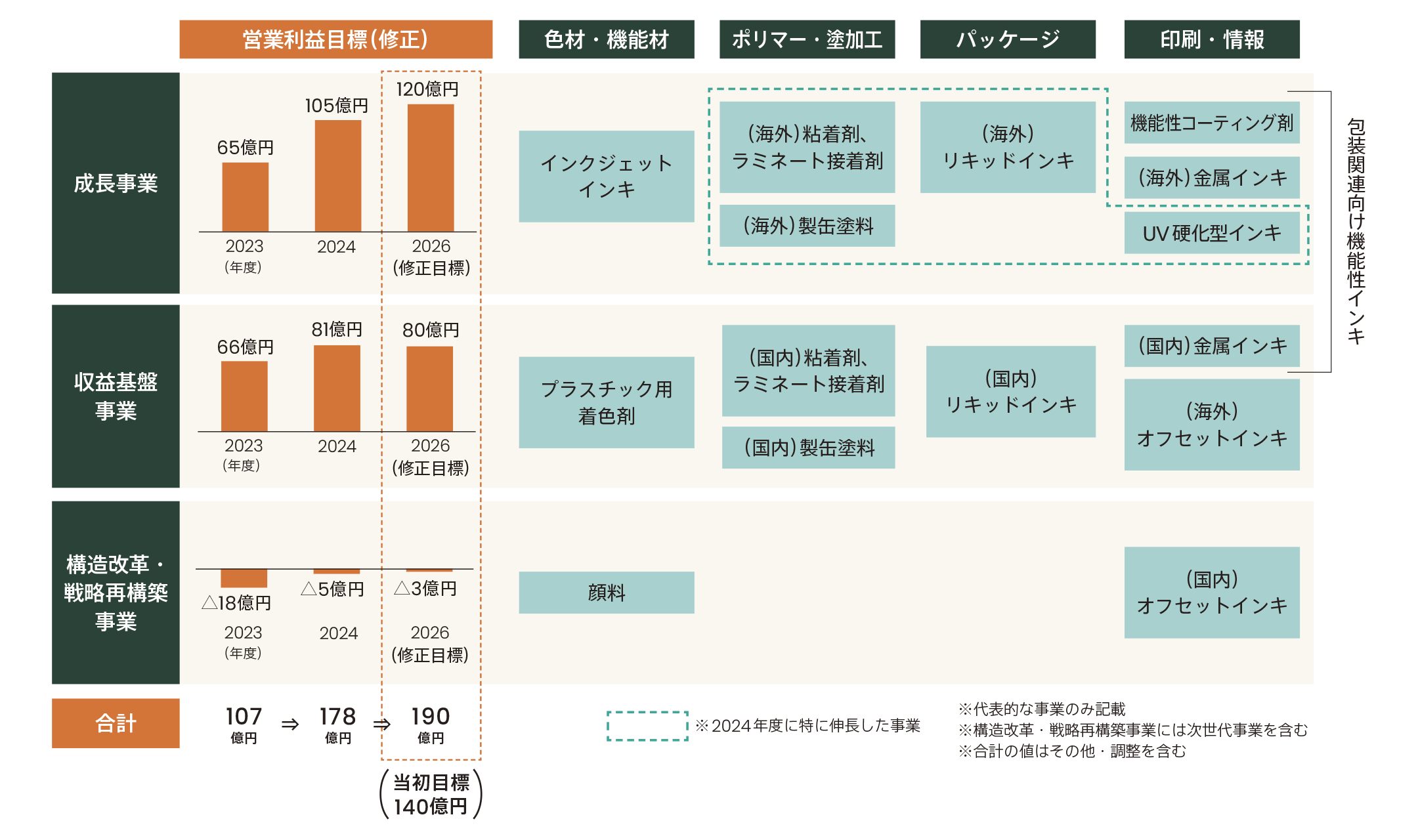

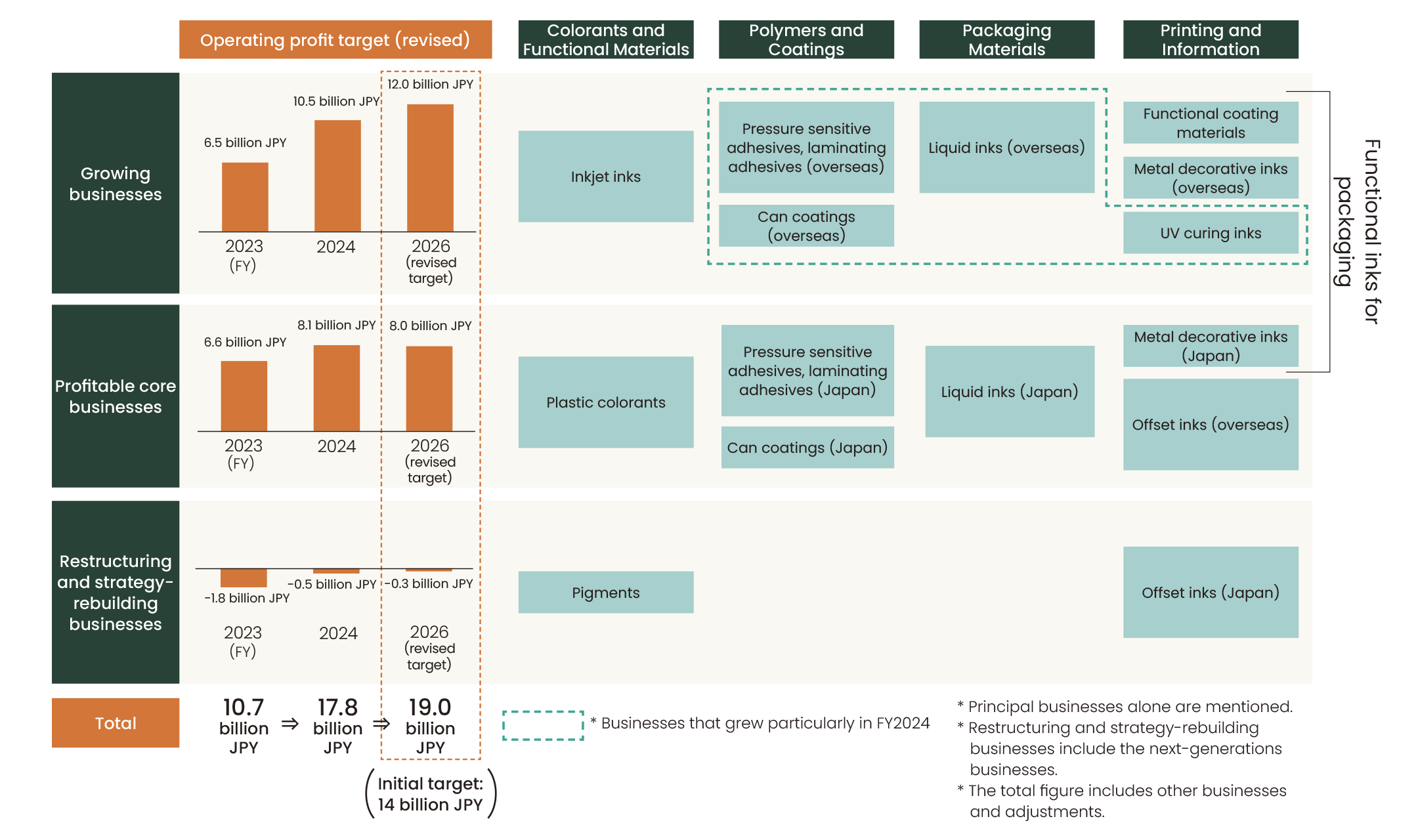

We have divided our existing businesses into three groups, growth businesses, stable earnings base businesses and businesses where we will implement a restructuring and rebuilding strategy; and determined approaches for each of these groups.

Of these, the growth businesses deal mainly with packaging-related areas such as liquid inks, pressure sensitive adhesives, and laminating adhesives, which require concentrated investment of management resources. At the start of artience2027, we set a target operating profit of 9.0 billion JPY for FY2026. We have already achieved operating profit of 10.5 billion JPY in FY2024, significantly exceeding our target. One factor contributing to this achievement is that our business has expanded beyond our target markets of India, Southeast Asia, and Turkey to include Europe and the United States.

We believe that our strategy of adapting our business model to the needs of each region — rather than simply replicating our domestic model — has been successful. For example, in the Indian market, technical services impact customer satisfaction. We have established a system that enables us to respond immediately to any problems that arise during product use, and have also trained local national staff to handle such situations. In Thailand, we have acquired a local can coating manufacturer as a subsidiary, which has expanded our market share by enabling us to develop products tailored to customer needs. This has also led to improved raw material procurement capabilities. As this is an area that is expected to continue growing in the future, we have raised the FY2026 operating profit target for this business to 12.0 billion JPY.

On the other hand, there are still countries with room for growth. In Indonesia, for example, local companies have strong ties with each other, which makes it difficult for foreign companies to reach the top of the market. We will address this issue by forming alliances with local companies and considering M&A. We will also be focusing on Africa as a new growth area. Although we already have a subsidiary in Morocco, given the vast size of the African market, we will identify and select locations for expansion and initiate fullscale operations.

While our stable earnings base businesses are strong mainly in Japan, we believe that future growth in demand will be limited due to factors such as population decline. We are therefore working to secure profits by increasing the ratio of high value-added products, integrating product types, reviewing raw materials, and requesting price adjustments to appropriate levels. These steady efforts have already begun to bear fruit. We have already achieved 8.1 billion JPY in operating profit in FY2024, surpassing the 6.7 billion JPY target set for FY2026. Despite this, domestic prices continue to rise due to the weak JPY and increased costs from raw material manufacturers, making it essential for us to further improve efficiency and adjust prices accordingly. Our revised target for FY2026 is 8.0 billion JPY, based on the view that the current profit level will be maintained. Ensuring business continuity will require labor and personnel reductions, as well as compliance with environmental regulations. In particular, at production sites, we will aim to create smart factories to reduce the burden on workers and attract more human resources.

Meanwhile, the domestic offset ink market continues to shrink as a result of the shift toward paperless operations and digital transformation (DX.) In response to this situation, for businesses subject to our restructuring and rebuilding strategy, we have been making rigorous improvements in efficiency in line with market size, and are now approaching the break-even point. We believe that personnel shifts, the application of operational DX, the integration of bases, and the review of production systems have led to cost reductions, and we will continue these efforts in the future.

In the Printing and Information business segment as a whole, operating profit increased significantly from 2.4 billion JPY in FY2023 to 4.9 billion JPY in FY2024 due to our focus on UV curing inks. We consider this an example of the concrete results that can be achieved by shifting management resources to growth areas.

Classification of the main existing businesses and operating profit targets

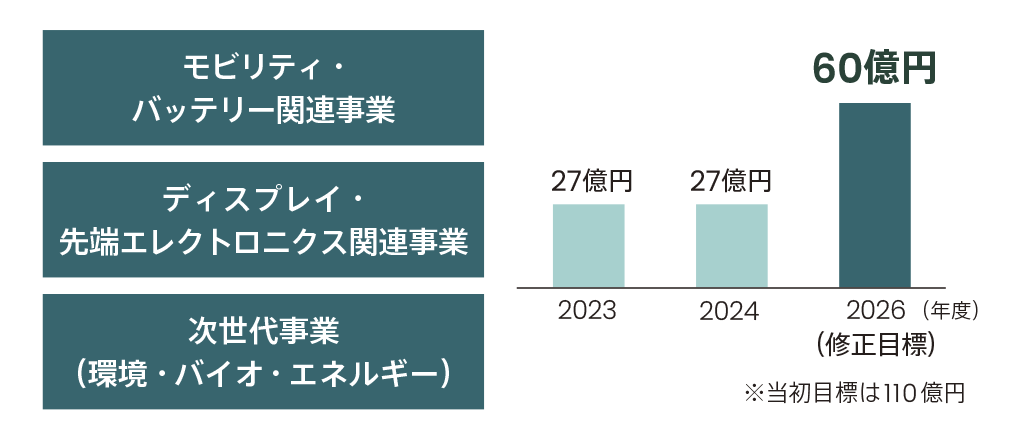

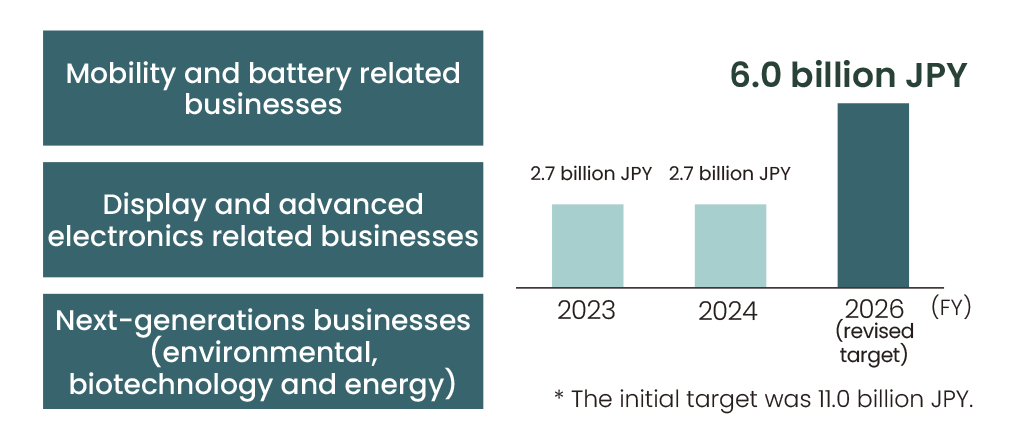

Creation of strategic priority businesses

The core of our new business creation efforts is Mobility and Battery Related Businesses. As our next growth pillar, we have been investing heavily in carbon nanotube (CNT) dispersions to improve the performance of lithium-ion batteries (LiBs) for electric vehicles (EVs.) In FY2024, the EV market stagnated due to factors such as the lowering of EV targets in various countries, reductions in subsidies, and delays in infrastructure development, forcing a review of plans. However, there is no doubt that the shift to EVs as a means of addressing environmental issues is a global trend, and we are focusing on future-oriented development in collaboration with automobile manufacturers and battery manufacturers. We are confident that our superiority in terms of our technologies and customer network is becoming increasingly robust, and will enable us to contribute to solving issues such as driving range, charging time, and cost in the spread of EVs.

In addition to cathode materials for our ternary (nickel-cobalt-manganese) batteries, we believe it is also necessary to respond to the demand for lithium-iron phosphate (LFP) batteries and anode materials, which are highly competitive in terms of price. Furthermore, we are working on the development of all-solid-state batteries, which are attracting attention as a next-generation technology, and lithium-manganese iron phosphate (LMFP) batteries, which are an improvement on LFP batteries. Our goal is to eventually cover all areas of LiB materials.

Another key area, Display and Advanced Electronics Related Businesses, performed well in FY2024, offsetting delays in the CNT dispersion business. Although individual products in this field are not particularly large, we will enhance our lineup by developing semiconductor-related products into product groups that will increase competitiveness and profitability.

Changes in operating profit of strategic priority businesses

Toward our long-term vision

We plan to continue prioritizing overseas expansion and investment in strategic priority businesses in FY2025 and beyond, while further strengthening our business portfolio management. In terms of business portfolio transformation, all directors recognize its necessity, and have agreed to allocate resources for this purpose. Active discussions regarding individual business plans are currently underway from various perspectives.

The expansion of overseas operations to their current level is also the result of bold investments to expand production capacity during the previous medium-term management plan period. To continue this policy, under artience2027, we plan to invest 60.0 billion JPY over the course of three years. This amount exceeds depreciation and amortization expenses.

Environmental considerations — such as reducing CO2 emissions and developing products that do not use organic solvents — are also important. As global efforts toward decarbonization accelerate and environmental regulations tighten in countries around the world, we have set a target of increasing our sales ratio of sustainability-enhancing products to 80% by 2030. This aligns with current needs, and we will continue to respond flexibly to the different regulations and market characteristics of each country.

Our goal is for overseas sales to account for at least 60% of our total sales by FY2026. Securing global human resources is essential to achieving this goal. To improve our sales and technical support capabilities and tailor them to the needs of each region, we will actively recruit and develop local personnel. Going forward, the Group will work together as a team to accomplish the goals of artience2027, maintaining an offensive attitude and striving to achieve significant growth.

Management Plan artience2027/2030 "GROWTH"