artience2027, Medium-term Management Plan | Integrated Report 2025Financial Strategy: Driving financial reforms focused on improving capital efficiency

Published on June 27, 2025

This page has been translated using AI.

Takeshi Arimura

Improving capital efficiency is an urgent issue for the artience Group. We will promote financial reforms through capital policies such as share buybacks, reducing cross-shareholdings, and improving the level of shareholder returns, as well as the group-wide introduction of capital efficiency management indicators, with the aim of improving our corporate value over the medium- to long-term.

Progress in the first year of the medium-term management plan

FY2024 was a year of major transformation for artience. Changing our company name — which had been used for over 100 years — and renewing our management philosophy had a significant impact on the mindset within the Company. This wasn’t just about replacing our signboards. The change has inspired a new mindset among our employees to radically transform all business activities and corporate operations, which has provided a major boost to our efforts to improve capital efficiency. The Finance & Accounting Department has also planned and implemented capital policies such as treasury share buybacks, introduced cash flow and efficiency indicators, and implemented measures to improve the capital efficiency of the Company as a whole. I believe that this was a year in which awareness of improving capital efficiency increased significantly throughout the Company.

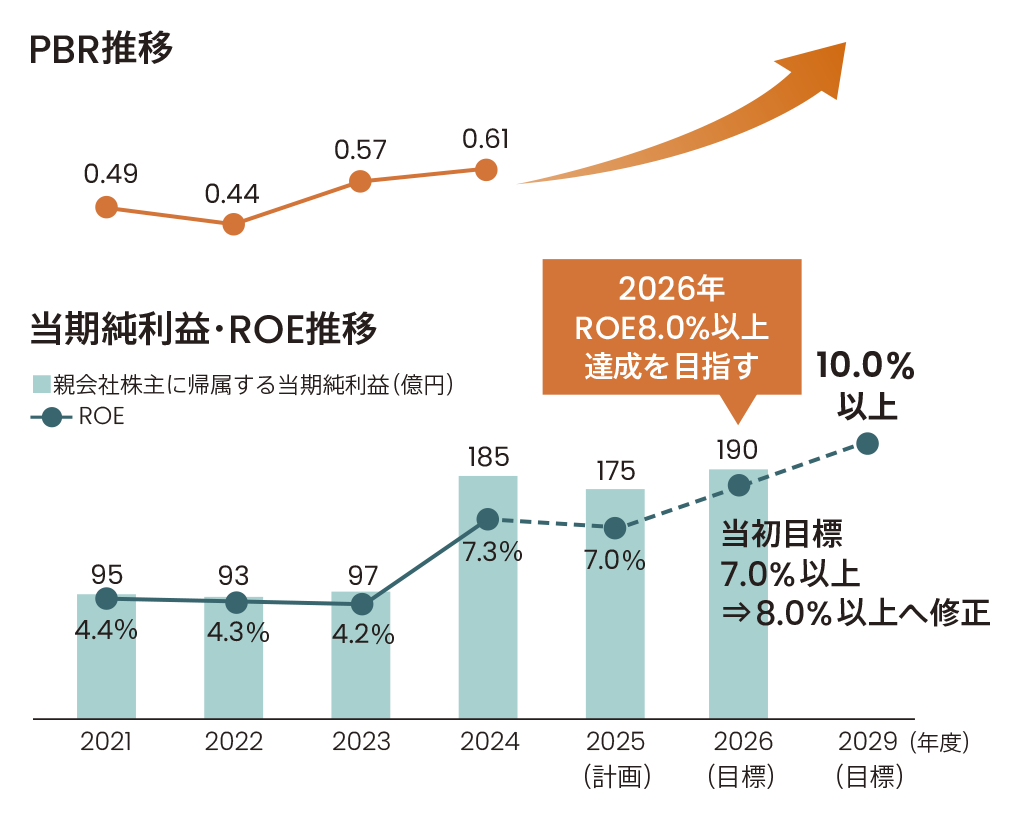

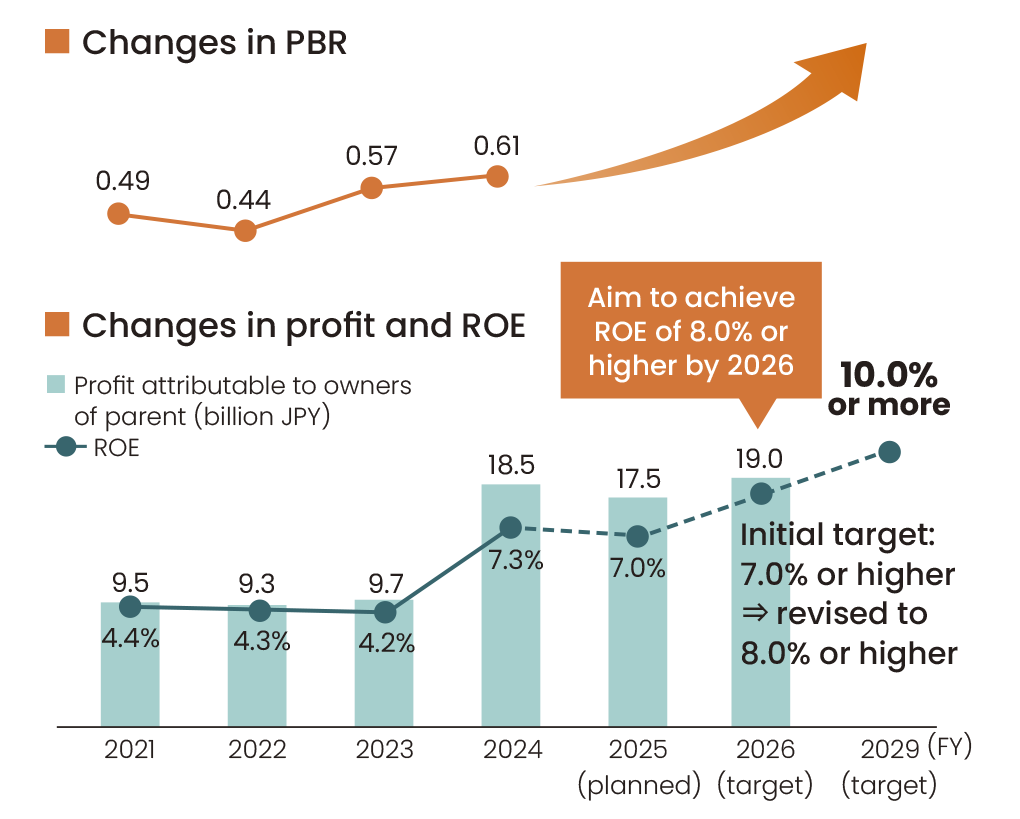

In FY2024, we introduced ROIC and CCC (cash conversion cycle) as internal management indicators. In February 2025, at the end of the first year of the artience2027, Medium-term Management Plan, the Company revised the original plan and announced an updated version, including treasury share buybacks and a policy to reduce cross-shareholdings. The original medium-term plan’s target of achieving an ROE of 7.0% or higher over three years was met in FY2024. However, this was due in part to onetime gains from the sale of shares and other special factors, so we do not consider this to be a satisfactory level. Going forward, we have set a revised target of 8.0% or higher as our actual performance figure, excluding special factors, and will work toward achieving this goal.

Financial reform measures (progress as of FY2024)

|

Business portfolio transformation |

|

|---|---|

|

Increase capital efficiency |

|

|

Capital policies |

|

|

Efforts to lower capital costs |

|

* Up to 4.5 million shares or 10.0 billion JPY (Purchase period: August 13, 2024 to August 12, 2025)

A major challenge for the Finance & Accounting Department is achieving a PBR of 1. There are two important points to consider in order to achieve this.

One of them is for us to achieve an ROE of 7.0% or higher, and then 8.0% or higher, based on actual performance rather than relying on temporary special factors. To achieve this, we have established the management policy of transforming existing business into highly profitable ones, and are working to improve the profitability of our existing businesses. The domestic Printing and Information Business, which had been operating at a loss for several years, achieved significant profits in 2024. The offset inks business in Japan has reduced its losses through structural reforms and price revisions, while other businesses have improved their ability to generate earnings by shifting to high value-added products, revising prices, and improving their efficiency. We have revised our operating profit target for 2026 for highly profitable existing businesses upward from our initial target of 14.0 billion JPY to 19.0 billion JPY.

Another key point is the establishment of new growth areas within our strategic priority businesses. Contrary to initial expectations, sales of LiB materials for EVs have fallen behind original targets due to the recent downturn in the EV market. However, we are preparing to respond to diverse demands when the EV market recovers. In terms of future growth businesses, we see promising signs of progress in the display, semiconductor, and advanced electronics sectors, and we will actively invest in these areas as growth fields.

In FY2024 CCC improved from 114 days to 111 days: an improvement of 3 days. Frontline employees worked enthusiastically to shorten the number of days required to collect inventory and accounts receivable. This is likely the result of increased awareness of our management policy to improve capital efficiency.

We still feel that there is more room for improvement in terms of ROIC awareness. We are engaged in various efforts to raise awareness. For example, by releasing results monthly instead of quarterly, we are increasing the frequency with which employees are exposed to such information.

Until now, we have previously reduced cross-shareholdings by verifying their economic rationality, comparing their associated benefits with the cost of capital, and reviewing transaction conditions. In FY2024, we took a further step by announcing a reduction policy. We are adopting a more proactive policy with the aim of maximizing capital efficiency. Going forward, we will carefully reduce our cross-shareholdings while maintaining good relationships with our business partners, and use the proceeds to make growth investments and increase shareholder returns, thereby enhancing corporate value.

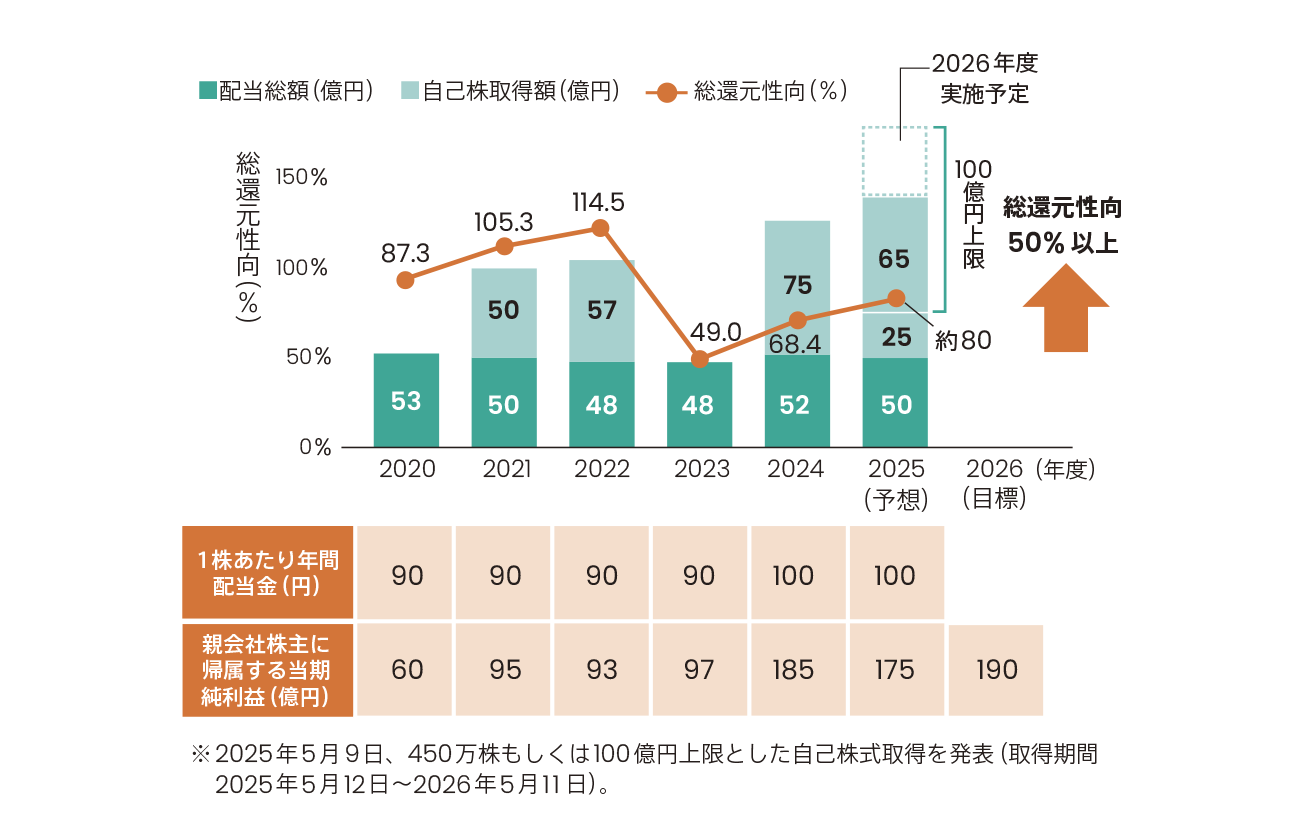

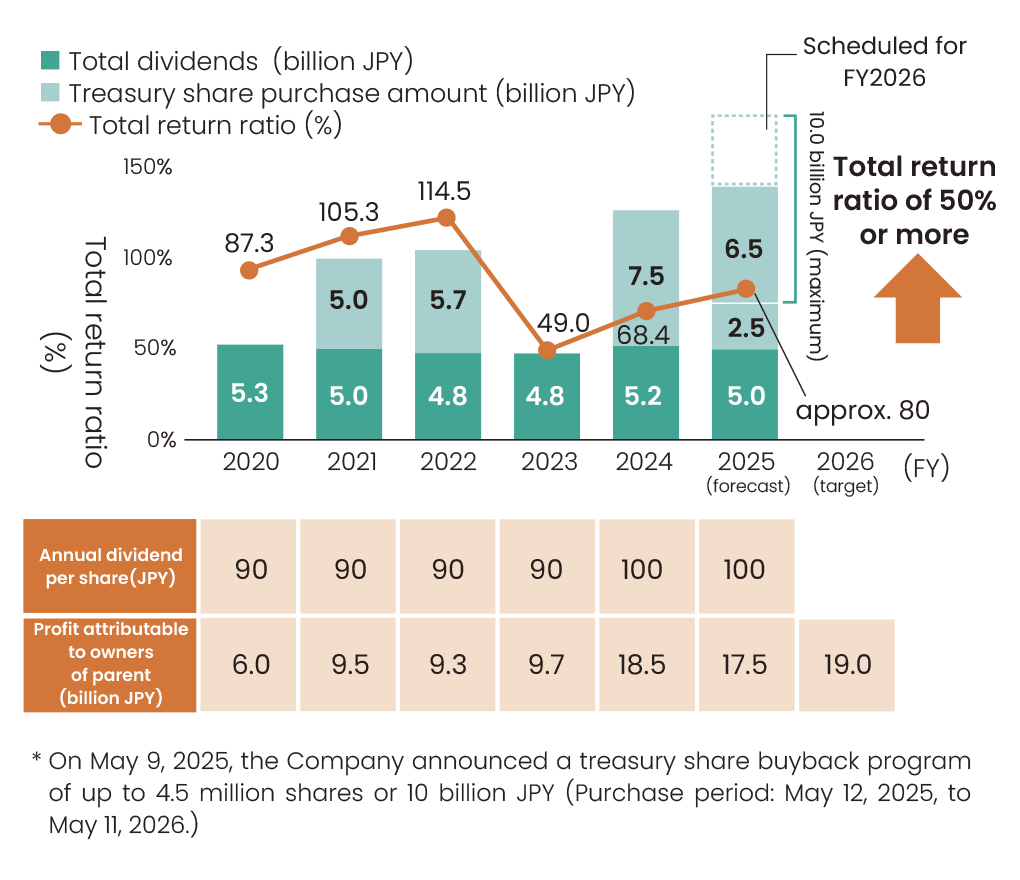

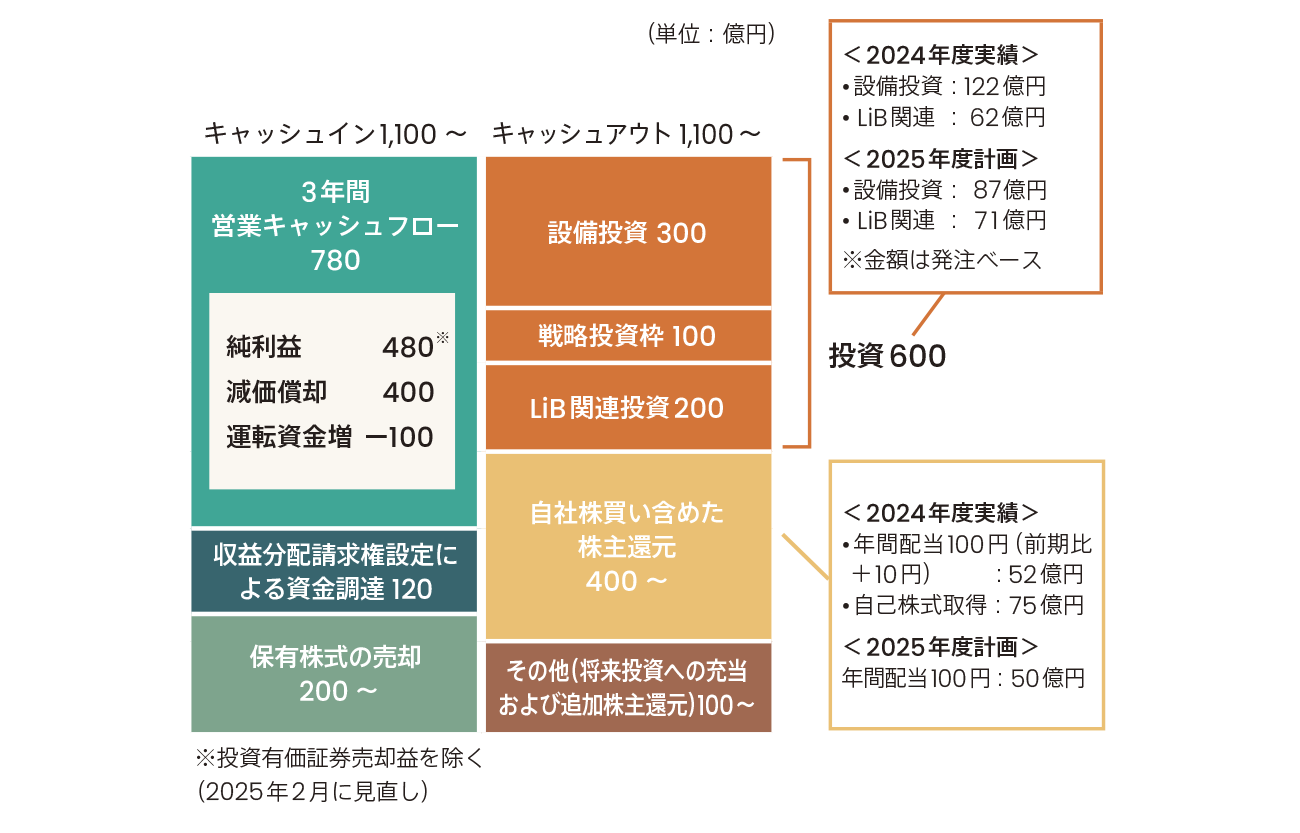

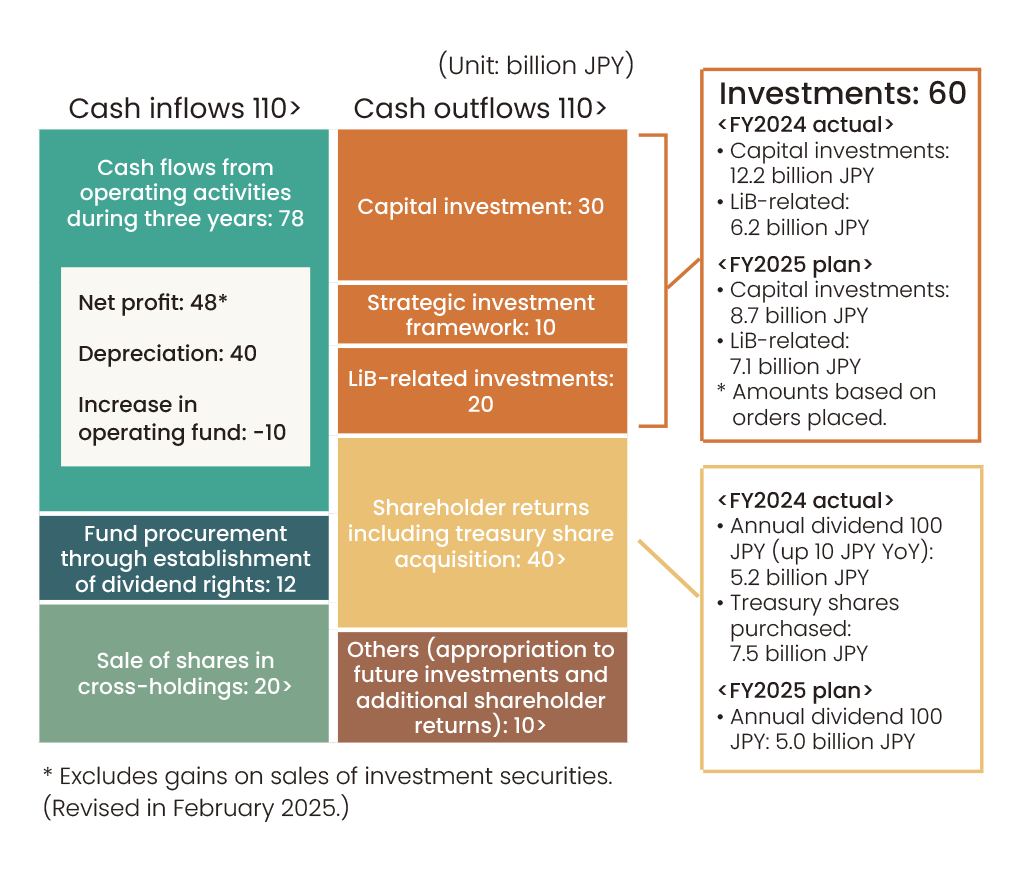

Our capital policy — prioritizing growth investments in cutting-edge electronics and growing overseas regions while actively returning profits to shareholders — remains unchanged. In FY2024, profits exceeded our plans, and so we have increased our planned operating cash flow for the three-year medium-term plan period from 40.0 billion JPY to 48.0 billion JPY. We have decided to return a portion of this to our shareholders.

Since we expect to surpass our initial targets for reducing cross-shareholdings, our policy will be to enhance corporate value by allocating the profits from this to growth investments and shareholder returns. Going forward, we will continue aiming to improve the level of shareholder returns in line with profit growth.

Shareholder returns

Cash allocation

Towards enhancing corporate value

Based on our Group policy of strengthening governance, we have increased the number of outside directors. Currently, the majority of our directors are outside directors. Since outside directors play an important role as representatives of shareholders and external stakeholders, we strive to enhance communication by taking time to explain proposals to them in detail. The decisions to review our treasury share buyback and cross-shareholding reduction policies in FY2024 were also made after thorough discussion by the Board of Directors. I believe that decisions are made with consideration for external requests as well.

Maintaining an “A” credit rating is essential for achieving an optimal capital structure. Without a solid financial foundation strong enough to maintain an “A” rating, we cannot invest with sufficient flexibility. As interest rates rise, a down-grade in credit rating would increase financing costs.

Improving capital efficiency is an urgent priority. While maintaining our “A” rating, we will pursue improvements in capital efficiency as a dual strategy to enhance medium- to long-term corporate value, aiming for a balance sheet that is appropriately matched to our progress of growth.

Management Plan artience2027/2030 "GROWTH"