Information Disclosure Based on TCFD Recommendations

Information Disclosure Based on TCFD Recommendations (2025)

Information Disclosure Based on TCFD Recommendations (2024)

Climate change caused by global warming, caused by an increase in global greenhouse gas (GHG) emissions, is one of the most important issues facing global society. artience group recognizes that addressing climate change is an important management issue that could have a significant impact on corporate activities, and in November 2020 announced its support for the Task Force on Climate-related Financial Disclosures (TCFD). In March 2023, we joined the Japan Climate Initiative (JCI), and in April 2024, we joined the GX League. Currently, based on the Sustainability Vision ASV2050/2030, which is the core of the Group's sustainability strategy, we are promoting climate change response activities such as reducing CO2 emissions to achieve carbon neutrality by 2050, and disclosing information in accordance with the TCFD recommendations.

Governance

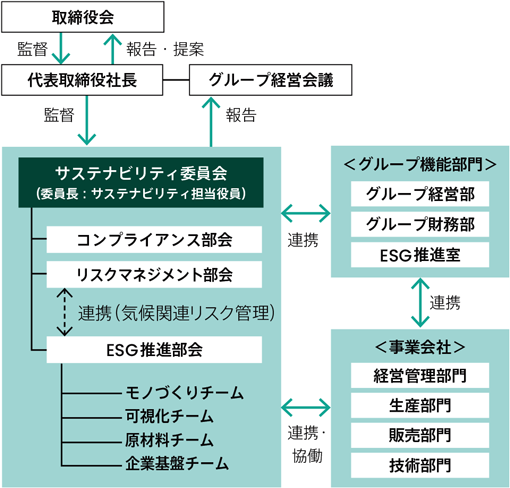

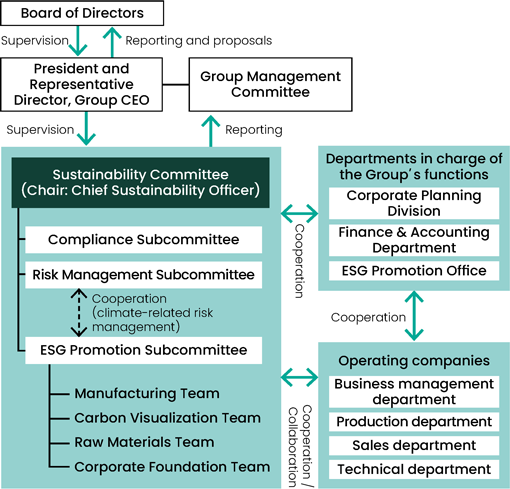

The Sustainability Committee, which oversees company-wide sustainability activities, including climate change responses, and promotes them across the organization, is under the supervision of Board of Directors through President and Representative Director. Important themes are discussed and resolved by the Group Management Committee and then reported to the Board of Directors for approval.

President and Representative Director oversees Sustainability Committee as the Group's chief executive officer for addressing climate change, and is ultimately responsible for management decisions related to company-wide sustainability activities, and at the same time, appoints an officer in charge of sustainability (Chair of the Sustainability Committee) as the executive officer responsible for the activities.

ESG Promotion Subcommittee, a subordinate organization of the Committee, plans and promotes specific activities related to company-wide sustainability, including responses to climate change. In addition, ESG Promotion Office, which was established in July 2023 to enhance the effectiveness of climate change response activities, will play a central role in collecting information on climate change responses, identifying, analyzing, and evaluating risks and opportunities, formulating internal rules, and disclosing information. We are working to strengthen cooperation within the system by strengthening the incorporation of climate change responses into management and business plans, and by promoting the realization and budgeting of various activities for climate-related targets.

| contents of report | |

|---|---|

| June 2023 | Report on the Second Phase of Climate-related Information Disclosure Based on TCFD Recommendations (Integrated Report 2023) |

| September 2023 | Formulation of decarbonization roadmap for each site and progress report on visualization of global CO2 emissions (Sustainability Meeting) |

| February 2024 | Sustainability Committee FY2023 Activity Report & FY2024 Activity Policy Explanation |

| Meeting body/organization | Roles and activities in response to climate change |

|---|---|

| Board of Directors | Approve and supervise all initiatives related to climate change as resolved in Group Management Committee. |

| Group Management Committee | Discuss and resolve important themes related to climate change and report to the Board of Directors. |

| Sustainability Committee | Deliberate on specific policies, plans, and measures related to climate change and report them to the Board of Directors and Group Management Committee. |

| ESG Promotion Subcommittee | Formulate and formulate specific policies, plans, and measures related to climate change response, and implement and promote activities in cooperation and collaboration with each department of each company. Regular meetings are held every month. Monozukuri Team: Support for the implementation of GHG emission reduction measures at each production site, aggregation and sharing of information, promotion of cross-functional planning Visualization Team: Formulation of rules for visualization of product CFP (carbon footprint), system construction, and system construction Raw Materials Team: Building a sustainable supply chain and promoting low-carbon raw materials to reduce Scope 3 emissions Corporate Infrastructure Team: Formulation of climate-related information disclosure strategies and disclosure practices based on TCFD recommendations |

| Risk Management Committee | Work with ESG Promotion Subcommittee to identify, analyze, and assess climate-related risks in the same way as other corporate risks. Regular meetings are held twice a year. |

| Group Functional Divisions | Promote and implement practical measures such as incorporating climate change responses into management plans, budgeting, legal responses, strengthening human capital, and disseminating information both internally and externally. |

| ESG Promotion Office | In cooperation with management, group functional divisions, and the management departments of each business company, we will strengthen the incorporation of climate change responses into management plans, and promote the realization and budgeting of various activities for climate-related targets. |

| Operating Companies | The business management, production, sales, and technology divisions in collaboration with ESG Promotion Subcommittee are responsible for incorporating and promoting climate change responses into business plans, collaborating with raw material suppliers and reforming production processes, marketing and sales promotion of low-carbon products, and research and development of technologies for low-carbonization. |

Risk management

Risk/opportunity management process

The Group has established a company-wide risk management system centered on Risk Management Committee, a subordinate organization of Sustainability Committee. We recognize that climate-related risks, like other corporate risks, are factors that affect the sustainable growth of the Group, and that appropriate strategic responses will not only prevent and mitigate the impact of risks when they occur, but also lead to opportunities such as increased business profits and improved market valuation. Climate-related risks and opportunities are managed by ESG Promotion Subcommittee and Risk Management Committee in tandem and by applying the same management processes as corporate risk in general.

ESG Promotion Subcommittee identifies and assesses climate-related risks and opportunities, reports them to Group Management Committee and Board of Directors, and holds the Sustainability Meeting (company-wide meeting) once a year to provide opportunities for not only management and department heads of Group companies but also general employees to attend the meeting in order to share information and awareness within the Group. In addition, by providing climate change-related education and lectures to all employees through e-learning and webinars, we are working to foster awareness of climate change-related issues, acquire the latest information, and improve risk sensitivity. Management and Group companies incorporate countermeasures and action plans based on these risks and opportunities into their management plans and business plans, and reflect them in specific measures.

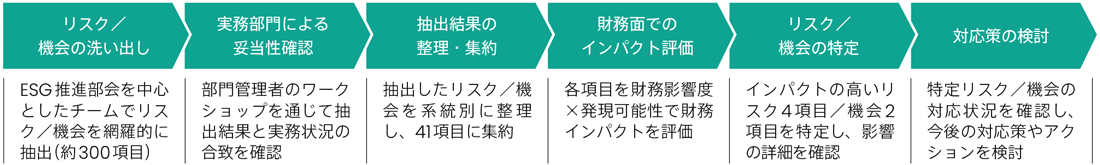

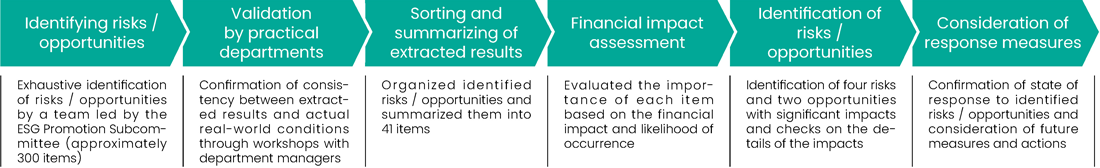

Risk/opportunity identification/assessment process

ESG Promotion Subcommittee uses the classification of risks/opportunities defined in the TCFD recommendations (transition risks: policy and law, technology, market, reputation, physical risks: acute and chronic, opportunities: resource efficiency, energy sources, products and services, markets, and resilience) and the matrix of the Group's value chain processes (procurement, production, logistics, sales, development, management, use, and disposal). Risks and opportunities associated with climate change were comprehensively identified. In addition, at a workshop for department managers of Group companies (held in February 2022 with 34 participants), we confirmed the validity of these sampling results (matching them with actual practices and on-site conditions). Subsequently, the approximately 300 identified risks/opportunities were organized and aggregated into 41 items, and impact assessments were conducted on two axes of financial impact and manifestability according to two different climate change scenarios (1.5°C and 4°C). Based on the results of this assessment, we identified four risks and two opportunities that are considered important for the Group. (December 2021 ~ May 2022)

Organized and consolidated risks/opportunities (partial)

|

Transition Risks |

Policy & Law |

・Increase in costs due to introduction of carbon tax and rise in emissions trading prices ・Strengthening and changes in environmental regulations such as GHG emissions and their impact on production facilities |

|---|---|---|

|

technology |

・Decrease in the value of existing technologies due to the transition to a decarbonized society ・Increase in capital investment, human resource development, and R&D costs associated with the transition to low-emission products |

|

|

market |

・Decline in demand for packaging and printing-related products due to the transition to resource recycling and decarbonization ・Increase in raw material and energy prices due to the use of non-fossil-derived and recycled raw materials and compliance with regulations |

|

|

reputation |

・Decline in preference due to inability to respond to customer requests to reduce GHG emissions |

|

|

Physical Risks |

Acute |

・Supply disruptions and loss of business opportunities due to supply chain disruptions due to weather disasters ・Increased recovery costs and loss of business opportunities due to damage to facilities and facilities caused by weather disasters and infrastructure outages |

|

chronic |

・Increased costs of measures and relocation of our bases located in flood/drought risk areas |

|

|

opportunity |

・Increase in sales due to increased demand for products that lead to energy conservation, GHG emission reduction, and resource recycling among customers ・Capture business opportunities by forming and expanding markets for new climate-related businesses (e.g., decarbonized materials and products for infectious diseases) |

|

strategy

The Group recognizes that global climate change and the policies and measures taken by national and regional governments have a significant impact on the market environment, raw material procurement, and consumer preferences, and have a strong impact on business continuity and business performance. In this regard, the Group has established the "Policy on Climate Change Response" (established in April 2022 and revised in January 2024), analyzes these risks and opportunities, and reflects them in management policies and business plans.

The artience Group (hereinafter referred to as the “Group”) recognizes that climate change caused by global warming due to the worldwide increase in greenhouse gas (GHG) emissions is one of the most important social issues facing global society, and that responding to climate change is an important management issue that can have a significant impact on the Group’s business activities. Based on this recognition, the Group will respond actively to global demands relating to climate change and work to contribute to the improvement of social sustainability through climate change response activities.

- Creating a system to address climate change

The Group has established a system under the direct control of management to oversee Group-wide activities to address climate change, and will work to implement measures to address climate change as a Group and introduce them into its management and business strategies. - Grasping and reducing GHG emissions

The Group has set the goal of achieving carbon neutrality by 2050, and will work to identify and reduce GHG emissions from its business activities as a whole. In particular, with regard to the reduction of GHG emissions, we will implement effective reduction measures throughout the Group, including our supply chain. - Provision of products and services that contribute to addressing climate change

The Group provides "environmental value" to society by developing and providing products and services that not only emit less CO2 during manufacturing, but also contribute to the climate change response activities of customers and consumers, such as reducing CO2 emissions during use and supporting adaptation to an environment with rising temperatures. - Addressing climate change risks and strengthening the resilience of businesses and business sites

The Group works to improve the resilience of its businesses and business sites by assessing and continuously monitoring risks posed to the Group’s business activities and sites by climate change, and taking appropriate measures to reduce or avoid such risks. - Appropriate disclosure of information on the activities to address climate change

The Group endorses and participates in the Task Force on Climate-related Financial Disclosures (TCFD) and other major initiatives to address climate change, and actively and appropriately discloses information on such activities. - Enlightenment and education on climate change

The Group will provide appropriate awareness-raising and educational activities for its officers, corporate advisors, and employees, in order to raise awareness and knowledge of climate change and activities to address it within the Group, and to promote the introduction of measures to address climate change into all business activities.

Established on April 25, 2022

Revised on January 1, 2024

Scenario analysis

The purpose of scenario analysis is to understand what risks and opportunities the envisioned climate change will create and what kind of impact it will have on the Group, to confirm the resilience of the Group's sustainable growth strategy in the envisioned future, and to consider the need for further measures.

The Group conducted a scenario analysis of four risks and two opportunities identified by the Group, referring to two scenarios: the 1.5°C scenario, which assumes a world in which various measures are taken to limit the increase in average temperature to 1.5°C above pre-industrial levels, and the 4°C scenario, which assumes a world in which climate change progresses while existing policies and systems are only applied.

| category | Risks/Opportunities | Event/factor | Financial Impact/Manifestability | Countermeasures/actions | Period of increased impact | ||

|---|---|---|---|---|---|---|---|

| 1.5°C Scenario | 4°C Scenario | ||||||

|

Transition Risks |

Policy & Law market |

Rising raw material costs and energy prices |

・Increasing demand for non-fossil derived/recycled raw materials ・Increase in countermeasure costs for suppliers due to stricter GHG (greenhouse gas) emission regulations ・Increase in raw material costs due to decrease in naphtha production |

Impact 3 / Likelihood 3 | Impact 2 / Likelihood 3 |

・Reducing high-cost raw materials by reviewing formulations and changing product lineups ・Stable procurement of raw materials by reviewing contracts with suppliers ・Reducing energy by shortening transportation distance by promoting local production for local consumption |

middle period |

| technology market reputation |

Decrease in packaging and printing-related demand |

・Growth of circular economy orientation in the market ・Progress in transition to a decarbonized society ・Progress in moving away from plastics in the packaging industry |

Impact 3 / Likelihood 3 | Impact 2 / Likelihood 2 |

・Review of business portfolio ・Strengthening superiority by improving product environmental performance and low emissions ・Appeal added value by displaying CFP on products ・Product development compatible with low-carbon packaging materials |

short term | |

| Policy & Law | Increasing cost impact of carbon pricing |

・Introduction of carbon tax - Imposition of carbon tax on fossil-derived electricity, addition of carbon tax price on raw materials ・Activation of emissions trading market, scarcity of emissions credits |

Impact 3 / Likelihood 3 | Impact 2 / Likelihood 3 |

・Promotion of passing on increases in raw material prices due to carbon tax to product prices ・Reducing and eliminating high-carbon raw materials through product formulation reform ・Active conversion to electricity derived from renewable energy ・Avoid purchasing emissions credits by thoroughly reducing direct emissions |

short term | |

| Physical Risks | Acute | Loss of business opportunities due to the intensification of weather disasters |

・Supply chain disruption due to weather disasters (shutdown of production bases, disruption of transportation of raw materials and products) ・Delays and suspension of supply of biomass raw materials due to adverse effects on farmland due to weather disasters |

Impact 2 / Likelihood 2 | Impact 3 / Likelihood 3 |

・Strengthening disaster countermeasures through BCM ・Building a complementary network of domestic and overseas production including other companies in the same industry ・Multiple raw material sources and transportation methods |

long term |

|

opportunity |

Increased sales of low-emission products |

・Increased demand for raw materials (including CO2-derived raw materials) and products with low emissions during production ・Increasing demand for products that help customers save energy, reduce emissions, and recycle resources ・Consumer expectations for carbon negative materials |

Impact 3 / Likelihood 3 | Impact 2 / Likelihood 3 |

・Priority selection and securing of low-emission raw materials ・Reduction of CO2 emissions in production activities ・Expand product lineup that takes into account low emissions from an LCA perspective (no need for heating or pre-treatment during use, easy recyclability) ・Promote research and development and commercialization of carbon negative materials |

short term | |

| Capturing business opportunities such as heat countermeasures and infectious disease countermeasure materials |

・Increasing demand for temperature countermeasures in living environments due to chronic temperature rise ・Frequent occurrence of emerging infectious diseases due to the effects of climate change ・Increasing demand for products with low risk of temperature-related accidents during storage and use |

Impact 2 / Likelihood 3 | Impact 3 / Likelihood 3 |

・Promote research and development and commercialization of materials that counter the deterioration of the living environment (heat) due to climate change ・Promote research and development and commercialization of medical-related materials (drug discovery, medication, medical devices, infection prevention, etc.) |

long term | ||

Financial impact: 3 = Impact is several billion yen 2 = Impact is around 1 billion yen 1 = Impact is less than 1 billion yen

Probability of manifestation: 3 = Already manifested or will almost certainly develop in the future 2 = Relatively likely to occur 1 = Low possibility of manifestation

Period of increased impact: Short-term = around 1 year (period of annual plan) Medium-term = around 3 years (period of medium-term management plan) Long-term = around 10 years (mid-term target year of ASV2050/2030 = period until FY2030)

1.5℃ scenario: See IEA World Energy Outlook: Net Zero Emission by 2050 Scenario and IPCC: SSP1-1.9

4°C scenario: see IEA World Energy Outlook: Stated Policy Scenario and IPCC: SSP5-8.5

Scope of analysis: Existing businesses of the entire group and new businesses currently envisioned

- Impact of carbon tax

- Amount of loss in the event of a flood in areas with high water risk

- Reducing CO2 emissions through the use of “environmental value” products that contribute to sustainability

Metrics and goals

Indicator 1. CO2 Emissions Indicators for Risk

Since the launch of the CO2 Reduction Project in fiscal 2010, the Group has been working to reduce CO2 emissions at its production sites in Japan and overseas.

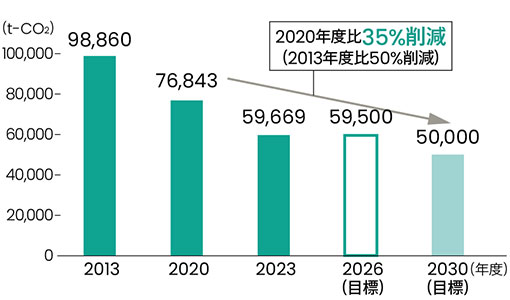

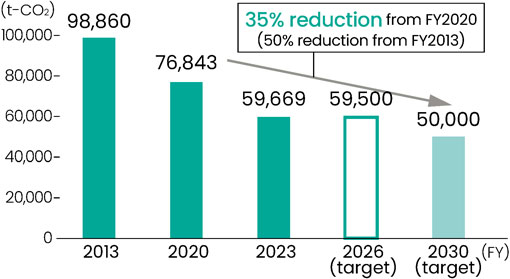

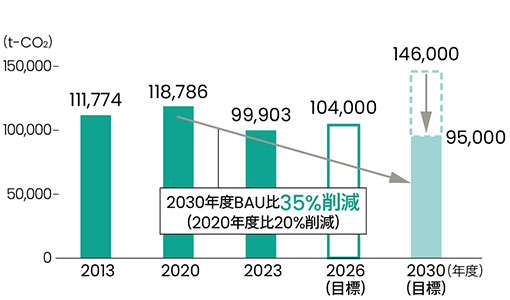

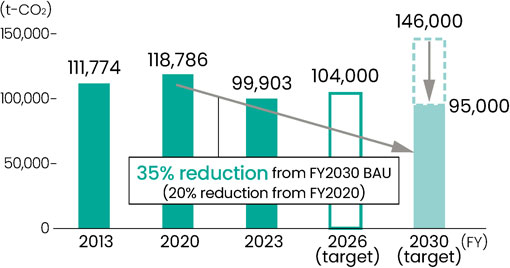

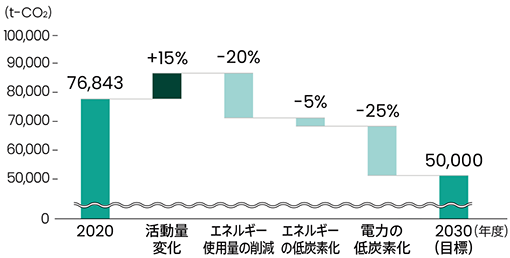

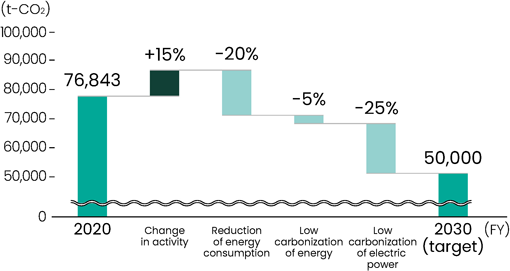

The Sustainability Vision ASV2050/2030 declares that the Group will achieve carbon neutrality by 2050 regarding CO2 emissions from its production activities. In addition, we have set specific interim targets of reducing domestic CO2 emissions by 35% (50,000 t-CO2) compared to FY2020 levels by FY2030 and reducing overseas emissions by 35% compared to BAUs by FY2030 (95,000 t-CO2).

In order to achieve these goals, we are taking various measures in three directions: reducing energy consumption, low-carbon energy, and low-carbon electricity. In Japan, where many cogeneration systems are in operation at production sites, we will focus on low-carbon energy by switching to low-carbon fuels used in systems and promoting the electrification of production facilities. On the other hand, in overseas countries, where the electrification of production facilities is relatively advanced, we will focus on low-carbon electricity, such as using renewable energy for electricity.

CO2 Emissions (Domestic) Trends and Targets

| Direction | Main measures |

|---|---|

| Reduce energy usage | ・Energy saving (Elimination of energy loss during the process) ・Reform of production processes from the perspective of energy conservation |

| Low carbon energy | ・Electrification of production equipment (reduction of direct emissions) ・Preparation and research for the use of LNG alternative fuels |

| Low-carbon electricity | ・Introduction of low-carbon electricity (reduction of indirect emissions) ・Introduction of renewable energy facilities |

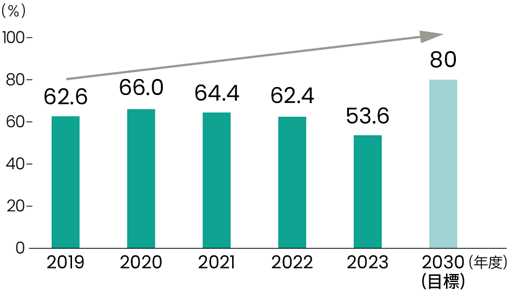

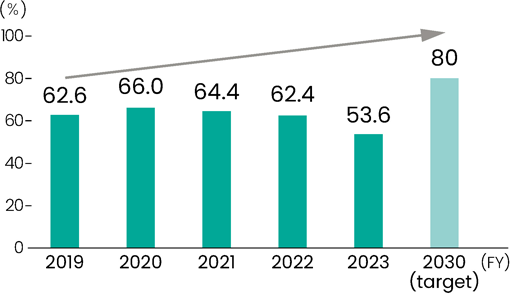

Indicator 2. Ratio of sales of products that contribute to sustainability Indicators for Opportunities

The Group has been working to improve the environmental friendliness of its products from an early stage, and has launched a variety of environmentally-friendly products since the 1990s. In our Sustainability Vision ASV2050/2030, we define "products that contribute to sustainability" as products that contribute to the improvement of the sustainability of society by expanding the scope of "life values" such as the comfort of people's lives, health and welfare, and safety and security in addition to the "environmental value" provided by these environmentally-friendly products. In its scenario analysis, the Group has identified "increasing sales of low-emission products" and "acquiring business opportunities such as materials to combat extreme heat and infectious diseases" as climate-related opportunities, and the sustainability contribution products include products and product groups that respond to these opportunities.

Under ASV2050/2030, we have set an interim target of increasing the ratio of these sustainability-contributing products to the Group's total product sales to 80% or more in Japan and overseas by FY2030 as one of the indicators for the Group's response to climate change.

* From FY2023, we are changing the definition and expanding the scope of aggregation (including overseas) to products that contribute to sustainability based on ASV2050/2030.

The figures up to FY2022 are the sales composition ratio of the legacy environmentally-friendly products.

| Value provided | Direction | keyword | Examples of Initiatives and Products |

|---|---|---|---|

|

environmental value Coexist with the environment |

Decarbonization | Clean Energy, New Energies energy reduction, Shift to EVs in Transportation |

Proposal and advanced development of materials and technologies that contribute to the acceleration of EVs (LiB materials, thermal control materials) |

| Contributes to the reduction of CO2 emissions during use (UV/EB conversion) Development of new environmentally-friendly power generation systems and proposals for materials |

|||

| Resource Recycling | Reduce reuse recycle Alternative materials |

Reduction and replacement of the ratio of petrochemical raw materials (biomass, water-based) | |

| Simplification of product composition, replacement with paper (biodegradable materials, functional coatings) | |||

| Development of materials and systems that support plastic circulation (materials and systems that support horizontal recycling) | |||

| Symbiosis with nature | Environmental Harmony, Symbiosis, and Purification Reduction of Environmentally Hazardous Substances |

Heat shield paint, heat preservation Soil improvement, wastewater purification, and utilization of renewable energy |

|

| carbon recycling | Taking on the challenge of CCUS (CO2 capture, utilization, and storage) technology and utilization of CO2-derived raw materials | ||

|

life value Comfortable, healthy, |

Medical & Healthcare |

Prevention/diagnosis | Development of diagnostic materials and systems that lead to early detection and prevention of diseases and reduction of morbidity risk |

| treatment | Development of pharmaceuticals and medical materials that contribute to advanced treatment and self-care | ||

| safe and secure | Providing safe and secure products that have no effect on living organisms (products that do not contain harmful substances) | ||

| Telecommunications & Electronics & Digital Domains |

High speed/large capacity communication | Development of next-generation materials that support photonics, high-speed large-capacity transmission, and high-speed calculations | |

| advanced sensing | Providing key materials to realize a sensor society and a society connected by IoT | ||

| big data | Taking on the challenge of technology that leads to the realization of a convenient society through the use of data | ||

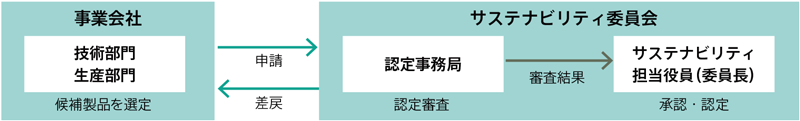

Certification System for Products Contributing to Sustainability

The Group's products are judged according to specific sustainability evaluation items, such as the direction and definition of environmental and living value, and GHG emissions intensity. If the evaluation of the target product meets the certification criteria, it will be certified as a "sustainability contribution product". The certification review is conducted by the Sustainability Product Accreditation Secretariat, and the Sustainability Officer (Chairperson) approves and certifies the results of the audit. In line with changes in sustainability requirements in the market and society, the screening criteria are reviewed periodically.