Risk Management

- Basic approach

- Promotion system

- Risk Management Process

- Main activities in FY2024

- Typical business risks

- information security

- Internal control

- Business Continuity Management (BCM)

Basic approach

artience group recognizes that it is important to understand the risks that may affect business continuity and to minimize the impact of risks by responding promptly and appropriately. Based on the "Basic Policy on Risk Management" (revised on January 1, 2024) and the "Basic Policy on the Development of Internal Control System" (revised on January 1, 2024), we have established the "Risk Management Activity Policy" as a policy of Risk Management Committee, and we are continuously reviewing and improving risks. In July 2025, we established our Business Continuity Plan (BCP) policy.

In order to achieve the goal of sustainable growth set forth by the artience Group (hereinafter referred to as the “Group,”) we believe that we must respond appropriately to the various risks surrounding the Group and operate the organization in a stable manner as we carry out our business activities. To earn trust as a corporate member of society by stabilizing our earnings through effectively controlling unforeseen damages and losses caused by risks that occur in various aspects of our business activities at the lowest possible cost, while preventing losses suffered by society — we have established this Basic Policy on Risk Management (hereinafter referred to as this “Basic Policy,”) and are working to implement appropriate risk management.

- Scope of application

This Basic Policy applies to all companies and organizations that make up the Group. In addition, all officers, corporate advisors, employees, contract employees, and part-time employees of the Group, as well as temporary dispatch workers and all other persons engaged in the Group’s business operations (hereinafter referred to collectively as “officers and employees”) are obligated to comply with this Basic Policy. - Respecting the laws and internationally recognized standards

The Group believes that compliance with laws and regulations and respect for international norms are the starting points for risk management, and acts in accordance with the laws, regulations, and international codes of conduct in the countries and regions in which it operates. In addition, the Group firmly maintains the philosophy and spirit instilled in the artience Group Code of Ethical Conduct, and its internal rules and policies, etc.; provided, however, that if a part of this Basic Policy cannot be applied due to local laws and regulations, the Group will comply with local laws and regulations while pursuing ways to respect international codes of conduct to the maximum extent. - Establishing and operating risk management system

The Group has established a Group risk management system with the Group Management Committee — which is the Group’s consulting and decision-making body, equivalent to the Board of Directors — as the highest decision-making body, and engages in risk management activities for Group-wide risks. At the same time, with regard to latent risks in the day-to-day operations of individual departments and organizations, each department and organization will operate a system aimed at preventing risks and mitigating damage when risks do occur, and work to share risk information throughout the Company. - Normal and emergency responses

The Group recognizes that activities during normal times to prevent risks are an important part of risk management, and works to prevent risks by incorporating appropriate crisis elimination functions into the risk management system. At the same time, the Group sets targets and formulates measures in advance for emergencies such as the occurrence of risks, and prepares for a smooth response to emergencies through education and training. - Risk analysis and evaluation

The Group analyzes and evaluates known risks and works to understand the types of risks, the extent and breakdown of their impact on business activities, and the costs, etc., required to prevent them. The Group also works to enhance its ability to perceive new risks arising from changes in the social environment through education and awareness-raising activities, identify Group-wide risks that need to be addressed as a group, and share them throughout the Group. - Implementation of education and training

The Group works to maintain and improve awareness of and approaches to risk management among officers and employees by providing appropriate education and training, to ensure that they are fully aware of risk management and comply with this Basic Policy and other relevant rules and regulations. - Revision, abolition and management

Decisions regarding the revision or abolition of this Basic Policy shall be made by the Board of Directors of artience Co., Ltd.

The department in charge of the revision and abolition of this Basic Policy shall be the department that oversees the risk management activities of artience Co., Ltd.

Established on November 1, 2004

Revised on January 1, 2024 (Resolved at Board of Directors on December 8, 2023)

Based on the “artience Group Philosophy System,” which consists of the Corporate Philosophy, the Brand Promise, and the Our Principles, the Company conducts its business activities in accordance with the “artience Group Sustainability Charter” and its related policies, and the “artience Group Code of Ethical Conduct,” to contribute to the creation of a sustainable society through its business activities and achieve its own sustainable growth.

The Company recognizes that the establishment of a system necessary to ensure the appropriateness of business operations (hereinafter referred to as the “internal control system”) is a process necessary for sound corporate continuity and the building of social trust, and that it should be actively utilized to achieve management and business goals. The Company has established the following internal control system and modify it in response to changes in the business environment, to ensure that the Company’s management is in the best interests of its shareholders and other stakeholders.

- Systems to ensure that Directors and employees perform their duties in compliance with the law and the Company’s Articles of Incorporation

The Company has established the Group Philosophy System that describes the ideal image the Group should aspire to and the basic ideas and actions required of the Group’s officers and employees, and the Code of Ethical Conduct that describes the rules to be observed by all officers and employees as members of the Group, and will disseminate them to all officers and employees as part of its efforts to instill awareness of the Group’s corporate ethics and compliance.

As a good corporate citizen, the Company aims to be part of a corporate group that is trusted by society based on the Sustainability Charter, which clearly defines the Group’s stance on corporate social responsibility and contributions to improving the sustainability of society.

The Company has established the Sustainability Committee, which is responsible for driving Group-wide sustainability activities under the supervision of the Representative Director. Under the Sustainability Committee, the Company has established the Risk Management Subcommittee, the Compliance Subcommittee, and the ESG Promotion Subcommittee. The Compliance Subcommittee plays a central role in ensuring compliance management. In addition, through the Compliance Office (internal and external whistleblowing hotline,) the Compliance Subcommittee enhances the system for early detection and correction of acts in violation of laws and regulations and the Code of Ethical Conduct.

The Board of Directors confirms the legality of Directors’ execution of their duties and also makes decisions on important matters which impact the Company and the whole Group in accordance with laws and regulations and the articles of incorporation. The Representative Director performs their duties on behalf of the Company as a whole, based on decisions made by the Board of Directors.

The Audit and Supervisory Committee, where a majority of members are Independent Outside Directors, audits the legality and appropriateness of Directors’ execution of their duties and reports the results obtained through its audit activities to the Board of Directors in a timely and appropriate manner. Meanwhile, in response to requests from Audit and Supervisory Committee Members selected by the Audit and Supervisory Committee (hereinafter referred to as “Selected Audit and Supervisory Committee Members,”) Directors report to the Audit and Supervisory Committee on the status of execution of their duties.

The Group’s Internal Audit Department reports directly to the Representative Directors, and audits operations within the Company to ensure they are being carried out in compliance with laws and regulations and the articles of incorporation and in an appropriate manner and that the internal control system is working effectively. In addition to reporting audit results to the Representative Director and the Director in charge of internal control, the department also reports to and works in cooperation with the Audit and Supervisory Committee. - Systems for the storage and management of information relating to the performance of duties by Directors

The Company stores and manages information relating to the performance of duties by Directors in an appropriate manner in accordance with the law, and the Company’s Articles of Incorporation, Board of Directors Regulations and Information Security Regulations.

Directors and Audit and Supervisory Committee Members are able access the relevant information as and when necessary. - Crisis management regulations and other systems relating to losses

Based on a system presided over by the Officer in charge of Risk Management, in accordance with Risk Management Regulations in line with the artience Group Code of Ethical Conduct, the Company identifies Group-wide risks and operates a risk management system designed to implement risk countermeasures, in order to maintain sound corporate activities and earn public trust, by the Risk Management Subcommittee.

In an effort to raise awareness of risk management, the Company incorporates risks and issues facing individual divisions and Group companies into its annual plans and employs management techniques that are built into its evaluation standards. The Company is also focused on preventing risks at all times, by having companywide risk countermeasures established and implemented by the Risk Management Subcommittee and the division in charge.

In case of an emergency, there is an emergency contact system in place whereby individual facilities immediately contact the Representative Director if they detect a risk. If the apparent risk could have a serious impact on the Company’s business, there is a business continuity system in place to immediately respond to the relevant emergency, by setting up an emergency task force for instance. - Systems to ensure that Directors perform their duties efficiently

To ensure that Directors perform their duties efficiently, the Company holds additional meetings of the Board of Directors as and when necessary, as well as regular monthly board meetings, with the aim of speeding up management decisions and running the business efficiently.

The Company also holds regular monthly meetings attended by Executive Directors and Operating Officers, as a means of discussing and making decision regarding Group management issues and business strategy. Meetings enable management issues and strategies to be shared, in an effort to efficiently achieve management and business targets. Such meetings are also attended by Selected Audit and Supervisory Committee Members, who provide the necessary input from an auditing perspective, thereby strengthening oversight with regard to the performance of duties by Directors.

The Board of Directors may delegate certain important business execution decisions to Directors who execute business in accordance with laws and regulations, the articles of incorporation, and the Board of Directors Regulations, for the purpose of increasing the flexibility of business execution. - Systems to ensure that operations are carried out appropriately as a corporate group consisting of the Company and its subsidiaries

The Company strives to maximize the corporate value of the entire Group, by sharing the artience Group Philosophy System, and making the most of management resources within the Group.

The Company has set out Affiliate Management Regulations to ensure that Group management is implemented appropriately, and requires Group companies to report on the performance of important matters in accordance with the relevant regulations, whilst still respecting the autonomy of individual Group companies. This ensures appropriate Group management, underpinned by involvement from the Company.

In addition to applying the risk management system and emergency measures outlined in the above section (3) to Group companies, the Company holds regular Legal Committee meetings for selected Group company Directors, and shares details of legal risks affecting Group management, in an effort to ensure that the Group is being run in an appropriate manner. Group companies hold regular meetings attended by Directors, amongst others, and work to achieve their management and business targets efficiently. They also report to the Company on a regular basis.

The Audit and Supervisory Board Members of each Group company shall audit the legality and appropriateness of Directors’ execution of duties at each company and report the results to the Board of Directors of each company and the Company’s Audit and Supervisory Committee.

The scope of the audits conducted by the Internal Audit Department in the above section (1) shall include each Group company.

By way of systems to ensure the reliability of financial reports, the Company consults its accounting auditor as and when necessary, based on an organizational structure headed by the Representative Director. It also establishes and operates effective internal control systems in accordance with standards for evaluating and auditing internal controls in relation to financial reports, published by the Business Accounting Council, and in line with the basic internal control framework set out in the relevant practice standards. In addition, the Company will develop a mechanism collecting information from the Group companies and sharing it with them, raise awareness of proper operational procedures and implement the appropriate internal audits of operation bases which were not identified as important bases on the basis of sales, when appropriate, taking into account the risks peculiar to them. - Matters relating to employees in the event that the Audit and Supervisory Committee requires the assignment of employees to assist with its duties

If the Audit and Supervisory Committee requires the assignment of employees to assist with its duties, the Company consults the Audit and Supervisory Committee and assigns employees to assist with the Audit and Supervisory Committee’s duties. The Company also sets up information sharing meetings between the Audit and Supervisory Committee and the Internal Audit Department, in order to strengthen systems to enable them to implement audits in conjunction with one another, and works to improve internal auditing capabilities in order to strengthen the auditing capabilities of the Audit and Supervisory Committee. - Matters relating to the independence of employees assisting the Audit and Supervisory Committee with its duties from Directors (excluding Directors who are members of the Audit and Supervisory Committee,) and ensuring that instructions issued to such employees are effective

In the event that employees are assigned to assist with the Audit and Supervisory Committee’s duties as outlined in the above section (6), they will be appointed and transferred with the agreement of the Audit and Supervisory Committee, which will then be responsible for issuing instructions to and evaluating the relevant employees. - Systems for Directors and employees to report to the Audit and Supervisory Committee; systems for Directors, Audit and Supervisory Board Members and employees at the Company’s group companies, and parties in receipt of reports from such, to report to the Audit and Supervisory Committee; systems for other parties to report to the Audit and Supervisory Committee; and systems to ensure that reporting parties are not disadvantaged

The Company’s Directors and Operating Officers report on the performance of operations under their supervision at important meetings attended by Audit and Supervisory Committee Members, including meetings of the Board of Directors.

Directors, Audit and Supervisory Board Members, Operating Officers and employees working for the Company or any Group company are required to report the following facts to the Audit and Supervisory Committee immediately, in accordance with Risk Management Regulations and other applicable regulations.- Important facts relating to compliance

- Facts that will cause, or could potentially cause, serious damage to the company

- Any other facts that are required to be reported based on consultation with the Audit and Supervisory Committee

In addition to requiring that Directors working for the Company or any Group company report the above facts to the Audit and Supervisory Committee, Selected Audit and Supervisory Committee Members also attend various meetings essential to auditing, and have access to information liable to have a serious impact on business operations, including approval documents.

Directors, Operating Officers and employees of the Company and each Group company are required to report on the status of company operations and property if instructed to do so by Selected Audit and Supervisory Committee Members. - Matters relating to procedures for advance payment or reimbursement of expenses incurred by Audit and Supervisory Committee Members in performing their duties (only expenses related to performance of duties of Audit and Supervisory Committee), and policies for processing other expenses or debts arising from the performance of such duties

If an Audit and Supervisory Committee Member claims for expenses incurred from auditing activities, the claim will be processed immediately. If incurring emergency auditing expenses or new research expenses for expert services, in addition to regular auditing expenses, the Audit and Supervisory Committee Member will notify the relevant officer in advance. - Other systems to ensure that Audit and Supervisory Committee Members conduct audits effectively

The Company continues to improve systems so that Audit and Supervisory Committee Members can conduct audits effectively, while exchange opinions with Representative Directors and other Directors regularly regarding management issues and other important issues affecting business operations.

The Audit and Supervisory Committee receives reports on planned internal audits conducted by the Internal Audit Department and regularly exchanges opinions with the Audit and Supervisory Board Members of each Group company and the accounting auditor, to ensure that audits are conducted by Audit and Supervisory Committee Members efficiently and effectively. - Systems aimed at combating antisocial forces

The Company is resolute in its rejection of antisocial forces posing a threat to the order or safety of people’s everyday lives, as specified in the artience Group Code of Ethical Conduct and the Regulations for Dealing with Antisocial Forces. The Company will not respond to any unreasonable or illegal demands, and will not have any relationship with antisocial forces, trading or otherwise. The Company also coordinates with external specialist organizations to gather and manage information relating to antisocial forces.

Established on May 15, 2006 (resolved at the Board of Directors on May 15, 2006)

Revised on January 1, 2024 (resolved at the Board of Directors on December 8, 2023)

- (Emergency response) Develop response plans and systems in the event of an emergency situation that may affect the entire group.

- (Prevention of risk manifestation, loss reduction/relocation measures) Identify and extract existing risks that may affect the entire group, and confirm and disseminate countermeasures.

- (Awareness activities) Promote improved ability to perceive new risks.

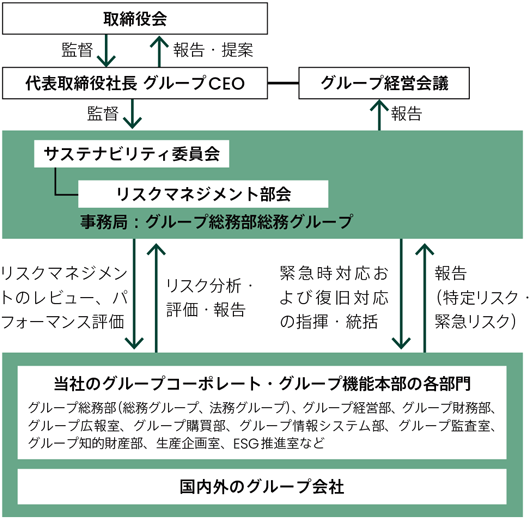

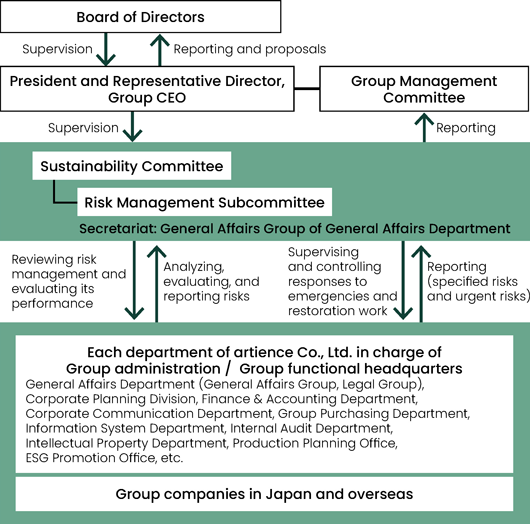

Promotion system

Under the chairmanship of the Officer in charge of Risk Management (Risk Management Committee Chairman), Risk Management Committee with General Affairs Department as the secretariat, comprehensively and comprehensively manages risks across the Group. In addition, each company and division of the Group identifies and evaluates risks hidden in changes in the social environment and daily operations, and works to prevent risks from occurring and take measures to reduce risk damage.

Risk Management Committee creates and shares risk maps that evaluate the risks of each company and department based on their likelihood and severity. For material risks, the subcommittee confirms the progress and achievement of risk mitigation activities, and reports company-wide risks that need to be addressed as a group to Group Management Committee and Board of Directors. When a new problem that could become a material risk arises, it is reported to Board of Directors and a task force is established to respond to it.

Risk Management Process

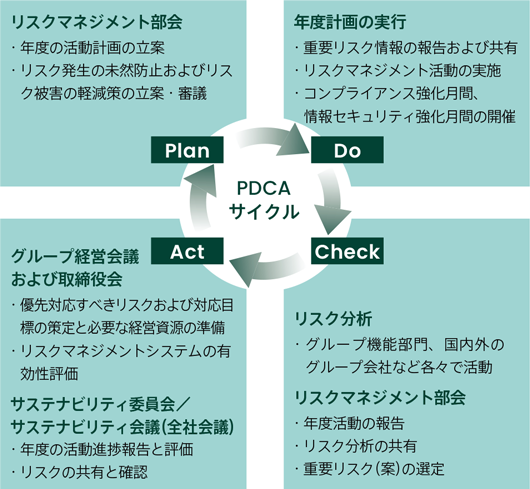

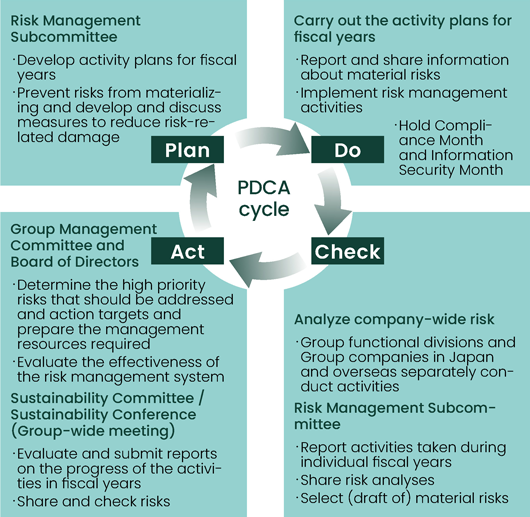

Under our risk management system, we are reviewing risks and working to improve the quality of our activities through the PDCA cycle.

Main activities in FY2024

In FY2024, we conducted a risk assessment from a company-wide perspective to confirm important company-wide risks, as well as (1) share the latest incident status through CSIRT, (2) confirm the status of response to quality fraud and quality defect risks, and (3) confirm the status of response to legal risks and share information. As for education and enlightenment activities, (1) safe driving seminars for drivers and managers of commercial vehicles at all sites in Japan, (2) safety education on the prevention of back pain accidents and the prevention of electrical fires using e-learning at production sites, including temporary employees and part-time employees (held twice in total: approximately 2,000 people attended each), and (3) to stabilize the quality of the entire Group and reduce risks. We created quality check sheets for each business and expanded them to overseas bases.

Typical business risks

The following risks are assumed as representative business risks that may have a significant impact on the Group's financial position, operating results, and cash flow situation. In fiscal 2024, there were no risks that would have a significant negative impact on the Group.

| Risk items | Typical risks |

|---|---|

| ① Potential risks of overseas activities | ・Changes in laws, regulations, and tax systems that adversely affect ・Negative impact on corporate activities due to the lack of social common capital - Occurrence of unfavorable political factors ・Social chaos caused by terrorism, war, etc. ・Unexpected and sudden changes in the working environment |

| (2) System failure, information leakage, Loss or damage Risks related to |

・Suspension of business due to system failure ・Information leakage, loss, or damage due to ransomware or other malware attacks, etc. |

| ③ Quality and product liability related risks |

・Accidents or complaints caused by product quality ・2024 Issues in Logistics |

| (4) Risks related to natural disasters, infectious diseases, etc. | ・Difficulty in procuring raw materials, disruption to production activities, stagnation in global consumption activities, and supply chain logistics functions due to natural disasters such as large-scale earthquakes and heavy rains, and pandemics of infectious diseases both domestically and internationally. Inability to supply due to stagnation, etc. |

| ⑤Risks related to raw material procurement | ・Price increases and supply shortages due to market fluctuations, natural disasters, accidents, policies, etc. ・Delay or suspension of the supply of raw materials from suppliers, or compensation for damages due to non-performance of supply to suppliers |

| ⑥Risks related to exchange rate fluctuations | ・Rapid exchange rate fluctuations |

| ⑦Risks related to general legal regulations | ・Changes in domestic and international laws and regulations and associated market changes ・Litigation disputes that have a significant impact on the Group's business, including environmental issues, product liability, and patent infringement |

| ⑧Risk of environmental impact | ・Changes in domestic and international environmental laws and regulations and associated market changes ・Increase in costs due to delays in responding to environmental load reduction ・Additional investment and changes in business format in response to social environmental demands (elimination of plastics, carbon neutrality, etc.) |

| ⑨Risks related to climate change | ・Changes in climate change regulations in Japan and overseas and associated changes in the market ・Increase in costs due to delays in responding to social demands, such as reducing CO2 emissions |

| ⑩Risks related to general debt collection | ・Difficulty in collecting trade receivables due to deterioration in customer business conditions |

| ⑪Risks related to impairment of fixed assets | ・Impairment of fixed assets due to changes in economic conditions or business reviews, etc. |

| (12) Risks related to human resources | ・Shortage of human resources due to changes in the social environment |

| (13) Risks related to human rights | ・Decline in social trust and suspension of transactions due to human rights issues ・Litigation disputes arising from human rights issues |

* Details of "Business Risks" are set out in the Annual Securities Report

information security

Internal control

Status of Establishment of Internal Control System

artience group recognizes that the development and operation of an internal control system is an important management issue, and Board of Directors has resolved the "Basic Policy on the Development of Internal Control System" (revised on January 1, 2024) to establish a business execution system and audit system to ensure the appropriateness of its operations.

Internal Audit Initiatives

In order to establish a sound foundation for business activities, the Group Audit Office conducts internal audits from the perspectives of legality, appropriateness, effectiveness of business activities, efficiency, and risk management, and provides advice and recommendations for improvements to the audited departments, as well as follow-up on the progress of improvements.

The Group's internal audits are mainly conducted annually to audit the development and operation of internal controls related to financial reporting (J-SOX audits) and audits of compliance and risk management initiatives based on instructions from management and requests from the risk management department (operational audits). The Group Audit Office reports the results of internal audits directly to President and Representative Director, internal control Director, Board of Directors, and Audit and Supervisory Committee, and also shares information with Operating Officers and department heads. In addition, we strive to improve the efficiency and effectiveness of audits by holding regular meetings with Audit and Supervisory Committee and Accounting Auditors to share information and exchange opinions on audit policies, plans, audit results, and other information.

In FY2024, we conducted internal audits at 12 companies (42 divisions) in Japan and 26 overseas companies.

Business Continuity Management (BCM)

The Group is working to address risks that may interfere with business continuity, such as natural disasters such as earthquakes, typhoons, and floods, pandemics such as infectious diseases, explosions, fires, and leaks at factories, and cyberattacks. In addition, we believe that it is important to build a recovery and product supply system in the event of an accident at a chemical company, including our own company, and we are promoting the development of BCM.

artience In accordance with the Basic Policy on Risk Management, the Group (hereinafter referred to as the "Group") strives to minimize the impact of significant impacts by taking preventative measures against risks that may interfere with business continuity as part of business continuity management (BCM) and making reasonable and sufficient preparations during normal times. In the event of a risk or unforeseen event that could have a significant impact on business continuity, the Group will establish a system for business continuity and early recovery, with the mission of ensuring the safety of employees, preserving assets, and fulfilling its responsibilities to society and stakeholders.

In accordance with its basic risk management policy, the artience Group (the “Group”) aims, as part of its business continuity management (BCM) initiatives, to minimize any risk that could significantly hinder the continuity of its business by taking preventive measures and making reasonable and sufficient preparations as a part of its normal practices. If a risk materializes or an unforeseen situation occurs that may materially affect the continuity of its business, the Group is committed to securing the safety of its employees, preserving its assets and fulfilling its responsibilities to society and its stakeholders, and the Group will build a framework for ensuring business continuity and recovering quickly from such events.

artience集团(以下简称"本公司集团")依据关于风险管理的基本方针,作为业务连续性管理(BCM)的一个组成部分,在日常工作中做好合理并且充分的准备,采取预防措施,防范可能对业务连续性造成影响的风险,最大限度地减轻重大影响。 当发生可能对业务连续性造成重大影响的风险或者不可预见的事件时,本公司集团以确保员工的安全、保护资产、履行对社会和利益相关者的责任为mission,构建旨在确保业务连续性和尽快恢复的体制。

- Scope of application

This policy applies to all organizations, officers and employees engaged in the business of the Group (including part-timers, temporary employees, and employees of partner companies, hereinafter referred to as "officers and employees, etc."). In addition, it will be applied to all related activities necessary for business continuity. - Objectives and Initiatives

The Group will ensure the continuity of its business activities by having the ability to respond to the emergence of risks that may affect business continuity (for example, natural disasters such as earthquakes, typhoons, and floods, pandemics caused by infectious diseases, factory accidents, cyberattacks, geopolitical risks, etc.). In this way, we will fulfill our social responsibilities while protecting the safety of our executives, employees, and other stakeholders.

The Group will predict, identify, and evaluate risks and establish a system to minimize the impact on its business. In order to ensure safety and business continuity, we will implement BCP based on the following basic concepts.

- The protection of human life is our top priority.

- Preserve and maintain the functions of business assets.

- We will reduce the impact on customers, local communities, business partners, executives and employees, etc. as much as possible.

- Strengthen communication and coordination for business continuity and maintain trust with stakeholders. - BCP System

In the event of the occurrence of risks or unforeseen circumstances that may have a significant impact on business continuity, we will establish an "Emergency Response Headquarters" headed by a person designated by the President of artience Corporation or the President of artience Corporation. The Emergency Response Headquarters will take prompt and appropriate measures to minimize damage, as well as to quickly rebuild business processes and quickly restore operations. - Continuous Improvement

The Group regularly evaluates the effectiveness of its BCP and strives to maintain and improve a flexible plan that can respond to changes in the environment and new risks. This ensures that we always maintain an optimal response system. - Global Initiatives

Regardless of the country or region, the Group will develop BCPs based on a unified global philosophy. We will promote activities based on a common policy at all sites and improve business continuity company-wide. - Implementation of education and training

The Group will provide appropriate education and training to officers and employees to ensure compliance with this policy and related regulations, regulations, etc., and will strive to maintain and improve their awareness of BCP even on a regular basis. - Repeal, abolition, and management

The revision or abolition of this policy will be decided and decided by the Risk Management Committee of the artience Group.

Date of enactment: July 1, 2025

- Scope of application

The BCP Policy (the “Policy”) applies to all the organizations, officers and employees who engage in the Group’s business operations (including part-time employees, temporary staff, employees of subcontractors, etc.; “Officers and Employees, etc.”), It also applies to all activities that are necessary and related to business continuity. - Purpose and policies

The Group will ensure that it is capable of handling any risk that may manifest and affect business continuity (for example, natural disasters such as earthquakes, typhoons and floods, infectious disease pandemics, factory accidents, cyberattacks, geopolitical risks, etc.) and it will ensure the continuity of its business activities. This enables the Group to protect the safety of the Officers and Employees, etc. and its stakeholders and fulfill its responsibilities to society.

The Group will develop a framework under which it will predict, identify and evaluate risks and minimize their impact on its business. It implements a business continuity plan (BCP) based on the following fundamental concepts to ensure business continuity and the security of the Group.

- The top priority is the protection of human life.

- The preservation of business assets and the maintenance of the Group’s functions will be promoted.

- Any impact on customers, local communities, trade partners and Officers and Employees, etc. will be minimized as much as possible.

- Communication and collaboration to ensure the continuity of business will be enhanced, and the trust of stakeholders will be maintained. - BCP structure

If a risk materializes or an unforeseen situation occurs that may materially affect the continuity of its business, the Group will establish an emergency headquarters headed by the President of artience Co., Ltd. or a person designated by the President. The emergency headquarters will implement prompt and appropriate response measures to minimize damage and work to quickly reconstruct business processes and restore operations. - Continuous improvement

The Group will periodically evaluate the effectiveness of its BCP and work to maintain and improve the plan to ensure that it will be able to flexibly respond to changes in the business environment and new risks. In this manner, it will always maintain an optimal response framework. - Global initiatives

Regardless of country or region, the Group will develop BCPs based on global and integrated principles. It will promote activities in line with its common policies at all of its bases and will improve its business continuity planning on a group-wide basis. - Offering education and training

The Group will provide appropriate education and training to its Officers and Employees, etc. to ensure that they observe the Policy and related regulations, rules, etc. and maintain and improve their awareness of the BCP as a part of their normal practices. - Revision or abolition and management

The Group’s Risk Management Subcommittee will make decisions regarding the revision, abolishment and management of this Policy.

Establishment: July 1, 2025

- 适用范围

本方针适用于从事本公司集团业务的所有组织、干部员工(含临时工、派遣员工等协作公司员工等,以下统称"干部员工等")。 另外,适用于业务连续性所需的所有相关活动。 - 目的与工作方针

本集团将加强应对能力,以应对可能影响业务连续性的风险(例如,可预期的风险包括但不限于地震、台风、flood等自然灾害、传染病导致的大规模疫情、工厂事故、网络攻击以及地缘政治风险),从而确保业务活动的连续性。 通过这种方式,保护干部员工等、利益相关者的安全,履行社会责任。

本公司集团将建立旨在预测、识别、评估风险,最大限度降低对业务的影响的体制。 本公司集团将基于如下的基本思路实施 BCP,以确保安全性和业务连续性。

- 保护人身生命安全优于全。

- Effort 保护经营资产和维持其功能。

- 最大限度地降低对客户、当地社会、供应商以及干部员工等的影响。

- 加强旨在实现业务连续性的沟通与协调,保持与利益相关者的信赖关系。 - BCP System

当发生可能对业务连续性造成重大影响的风险或者不可预见的事件时,成由artience株式会社的社长或者artience株式会社的社长指定的人员作为本部长的"紧急对策本部"。 紧急对策本部采取迅速且合理的应对措施,将损失控制在最小度,尽快迅速构建业务流程和迅速恢复其运用功能。 - 持续改进

本公司集团定期评估 BCP 的有效性,努力保持和改进在应对环境变化以及新风险方面具有灵活性的计划。 并通过这种方式始终保持最佳的应对体制。 - 在全球范围内的工作

本公司集团基于全球统一的理念开展 BCP 工作,不受国家和地区的限制。 依据所有基地通用的方针开展活动,提高公司整体的业务连续性水平。 - Education、培训的实施

为了让大家守本方针以及相关规程、规则等,本公司集团应对干部员工等进行适当的教育和培训,努力保持和提高干部员工等在日常工作中的 BCP 意识水平。 - 修订、作废及管理

本方针的修订和作废由artience集团的风险管理小组委员会决定和实施。

Date of enactment: July 1, 2025

- Establishing an emergency system

- Strengthening equipment earthquake resistance

- Response to weather disasters

- Stable procurement of raw materials

- Establishment of production supplementary system

- Expansion to overseas bases